NFTexplained.info is a team of long term crypto investors who are well versed in the space; we have the goal of providing valuable, educational content.

In this article we will break down what a centralized crypto exchange (CEX) is, what a decentralized crypto exchange (DEX) is and much more.

Before we really dive into the details that define each form of an exchange – including how they operate – we will take a look at the main differences.

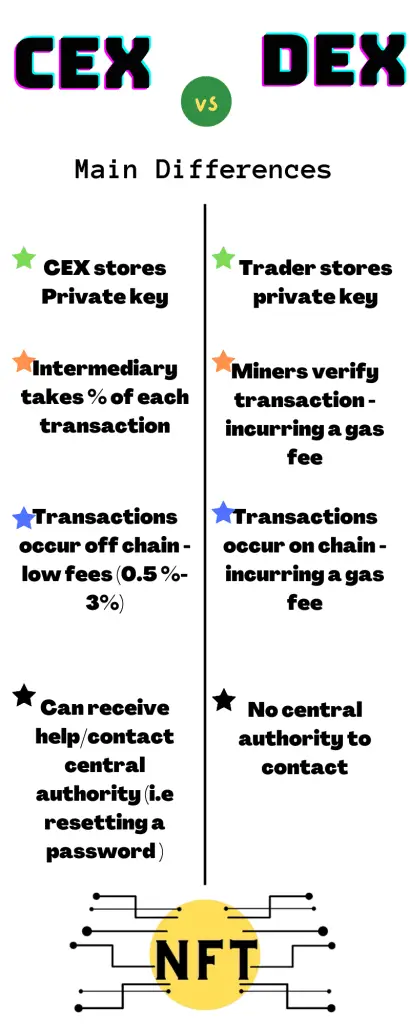

The main difference between a centralized and decentralized crypto exchange is that a CEX stores your private keys; in a DEX, the trader is the only one storing their private keys. Additionally, CEX take a percentage of each transaction while DEX rely on miners to verify transactions which incur a gas fee.

Both centralized and decentralized crypto exchanges have benefits as well as disadvantages. The vast majority of transactions on crypto exchanges currently happen on centralized platforms.

Centralized exchanges like Coinbase hold access to your private keys which can be thought of as the master key which allows you to access your digital assets.

Coinbase stated that holders would not be able to access their crypto in the event of bankruptcy and that traders would not be able to claim any property. This is a prime illustration of the saying, “not your keys, not your crypto”.

The team at NFTexplained.info highly recommends using cold storage which holds your private keys offline. More insight into the importance of cold storage can be found here.

Since decentralized exchanges are a peer-to-peer marketplace, there is no middleman taking a percentage of each transaction. However there are gas fees. Peer-to-peer means buyers and sellers are connected (without an intermediary).

In a DEX, nobody holds your private key except you. In the case that you have forgotten your DEX private key, you will have lost access to your crypto and unfortunately won’t be able to contact anyone regarding the issue.

Decentralized exchanges are more anonymous as no passwords are needed and users can access their cryptocurrency by simply typing in their private key. Centralized exchanges often offer customer support and give you the ability to reset your password.

The ability to reset or contact someone to help you gain access to something is not possible with decentralization and is a risk that comes with it.

Our team also mentioned the differences that come with the way transactions are processed. Centralized exchanges generally process transactions through an intermediary which occurs off chain – this is why no gas fee is incurred. However, a percentage is taken from each transaction (this is typically half a percent to three percent and is the primary way centralized exchanges make money).

Decentralized exchanges have gas fees as miners are required to verify transactions. A gas fee is the reward a miner receives for confirming that a transaction is correct. An analogy to illustrate the difference between the two is that a CEX has a person to confirm the transaction – off chain (which is why there is no gas fee) while a DEX has a computer/miner confirm the transaction on chain.

Gas fees vary in price greatly and depend on the number of people looking to make a transaction. If there is high demand for a transaction to be processed, gas fees could be up to a thousand US dollars however it is often far less then US $10.

To quickly summarize the distinctions between these entities, our team has created a side-by-side comparison of the key differences between the two:

Another core difference is that a DEX typically has a liquidity pool. Liquidity pools are created by traders who are incentivized to add funds as they receive a small percentage of transactions. This means a DEX has two fees – the miner (or gas) fee as well as the small fee that is distributed to liquidity providers.

To get a better understanding of the differences, let’s take a more thorough look at how CEX and DEX work.

How Do Centralized Crypto Exchanges Work?

Centralized crypto exchanges work by acting as a custodian (taking a percentage of each transaction) between buyers and sellers; buyers/sellers have the option to transact fiat for digital assets and vice versa. These transactions occur off chain and therefore don’t incur a gas fee. CEXs also store your private keys.

Something that is unique to CEX is that fiat can be used to make transactions; this is not possible with DEX as the DEX’s native blockchain cryptocurrency must be used to reward the miner for verifying a transaction (aka the gas fee). DEX only allow for the swapping of cryptocurrencies.

If you are a U.S. trader looking to receive a discount, consider using our business partner Binance!

Now our team will provide a more thorough explanation as to how DEX work including how they run.

How Do Decentralized Crypto Exchanges Work?

Decentralized crypto exchanges primarily work through connecting buyers and sellers directly; this is facilitated by automated market makers via smart contracts or by an order book system. Transactions occur on chain, meaning miners verify transactions.

This seems complex, so our team will further break down how DEXs work.

A DEX primary works through automated market makers (AMM) which is a system that relies on smart contracts. Smart contracts are code governing the predefined requirements that must be met in order for anything to execute. Our full guide to smart contracts can be found here.

In the AMM model, funds are often being gathered by liquidity pools. Liquidity providers are frequently called ‘liquidity miners’ and are those who lock funds in DEX liquidity pools. These traders are incentivized to participate in ensuring the smooth completion of transactions as a small amount of each transaction is awarded back to the liquidity provider.

Another way DEX works, although less common, is by using order books. Order books take all the data for those who are looking to purchase an asset at a specific price as well as all the data for those looking to sell an asset for a specific price. This is what determines the depth of the order book.

Our team at NFTexplained.info will note that liquidity issues with decentralized exchanges can deter large traders from using a DEX as slippage can occur. Slippage occurs when a buyer pays above market price for their orders.

Now we will discuss which one is better for your personal needs.

Are Centralized Or Decentralized Exchanges Better?

CEX and DEX have pros and cons, making each one better depending on the trader’s needs. CEX offer trading in fiat, more liquidity, faster transactions and other benefits. DEX offer greater security as traders hold their own assets. DEX allows buyers and sellers to connect directly which can reduce transaction costs.

CEX traders can buy crypto with fiat, making the onboarding process easier and more user friendly for beginners. CEX have more liquidity making it better for traders looking to transact with large amounts. CEX offer a much smaller number of tokens to buyers as each project must adhere to regulations in order to be listed.

Since transactions occur off chain, CEX typically have much lower fees as the centralized platform takes approx. 0.5% – 3% on each transaction; gas fees can run rampant when there are many people looking to transact. CEX often offer far more trading abilities/features such as leveraged trades which is something not offered by DEX; however, this advanced trading functionality is widely thought to be coming to DEXs in the near future.

One important factor worthy of your consideration is that the vast majority of CEX strictly adhere to regulatory requirements, including know-your-customer (KYC). Using a CEX may be more beneficial to traders if more regulatory requirements come into play, however a DEX can never be shut down as it is fully decentralized.

On the other side of the coin is a DEX which is widely considered to have more security. That being said DEX can also be hacked however it is less common. This is one reason why our team so heavily promotes a cold storage wallet so that sensitive data like private keys – or the master key to your assets – can be held offline.

DEX are connected simply by entering in a wallet that is compatible with the supported blockchain; this means the private keys are held by the trader themselves and not stored by the platform (which is the opposite of what occurs in a centralized exchange).

Since DEX are decentralized, there is no intermediary taking a percent of each transaction but as our team stated gas fees can run rampant (depending on the day and time you are looking to make a transaction).

One final factor to bear in mind: any coin can easily be listed on DEX as no requirements have to be met. This can be dangerous as traders may be duped into investing in a rug pull. Listings on a CEX are typically well vetted and adhere to any necessary legal requirements.

Now our team will cover some FAQs we have received via our Instagram & Twitter DMs.

Is Crypto Centralized Or Decentralized?

The vast majority of cryptocurrencies are fully decentralized however there are some tokens that are centralized. The primary reason as to why some tokens are centralized is because of the nodes; nodes typically help in determining if a block of transactions are legitimate.

Additionally, there are cryptocurrencies that start off fully centralized and work towards becoming fully decentralized. There are also cryptocurrencies that are primarily decentralized and are working to become fully decentralized; there are also cryptocurrencies that are happy to remain partly centralized.

Can You Sell Crypto On A DEX?

It is possible to swap a cryptocurrency for a stablecoin – which is pegged to an external reference – if that stablecoin is supported by the DEX. In a DEX, it is not possible to sell crypto for fiat currencies (e.g. US dollars, Euros) directly.

DEX exclusively allow for crypto to be exchanged for other cryptocurrencies. Stablecoins can be exchanged for other cryptocurrencies depending on the trading pairs supported by the DEX.

Are Centralized Crypto Exchanges Safe?

Centralized crypto exchanges can be hacked but are considered safe by the vast majority; it is important to own your private keys – which is the master key to your digital assets. Keeping your private keys offline is the best way to ensure the safety of your digital assets.

More on the importance of private keys and owning a hardware wallet can be found here.

If you already understand the importance of having cold storage/hardware wallet, our team would recommend checking out our article where we discuss which hardware wallet will be the best fit for you; that article is linked here.

Is Binance Centralized Or Decentralized?

Binance is a centralized cryptocurrency exchange. The vast majority of the most popular crypto exchanges are centralized; another good example is Coinbase.

Can I Sell Crypto On Uniswap?

Uniswap is a widely used decentralized crypto exchange and currently sees the most trading volume out of any decentralized exchange (at the time our team has written this article).

It is not possible to sell crypto on Uniswap as crypto can only be exchanged (this is true on all decentralized crypto exchanges). On a DEX, it is possible to exchange crypto for stablecoins. Crypto can also easily be sent to a centralized exchange where fiat can be received.

What Are Some Examples Of Decentralized And Centralized Crypto Exchanges?

If you would like to support our team’s content creation please consider doing business with our partners:

Trade stocks & crypto on Webull – get 2 free stocks!

Buy a Ledger hardware wallet!

US-based traders can get a crypto trading discount on Binance!

The NFT space is always changing and the technology is quite new. Our team is incredibly excited to see what will happen as time goes on. To get the latest news in this rapidly evolving space, follow our team on Instagram & Twitter!