The cryptocurrency space is decentralized. While there are clear benefits to decentralization – lowered risk of censorship, decreased risk of a single point of failure and more – being unable to reverse transactions is one of the challenges associated with decentralization. So what is meant by “lost coins” in the cryptocurrency space?

Lost coins refers to cryptocurrencies or digital assets that are no longer accessible; this could be due to an array of reasons including losing access to your private keys (aka the master key to your funds), sending crypto to the wrong account, forgetting passwords, and more.

One of the downsides that comes with decentralization is that you are the sole person capable of getting access to your account; this means there is nobody to contact for help. There have been numerous times when cryptocurrency whales have lost access to their private keys and therefore lost millions worth of assets (eg. the sad case of James Howell, which we will discuss later in the article).

Private keys are the master keys to your cryptocurrency account; they are what enable you to sign transactions and have full control over your digital assets. What holds all your private keys or all the control over your blockchain wallet is the seed phrase.

Seed phrases – the all-powerful random set of 12, 18, or 24 words – can be considered to be the master password to your entire crypto account; your seed phrase allows you to access each and every private key for your crypto.

For example, if you lost access to your Ledger hardware wallet, you would still be able to regain full control over all your funds, provided that you had your seed phrase. Aside from losing access to your private keys through losing your seed phrase, lost coins can occur as a result from sending funds to an incorrect address.

Sending crypto to the wrong address is an irreversible mistake; if you send funds to a black hole address (i.e. 0x000000…) nobody would be able to access those funds. Additionally, if you accidentally sent funds to the incorrect address, it would be essentially impossible to track down the owner of that blockchain address.

Forgotten passwords is another way that coins are lost in the cryptocurrency space; however, this issue is less common as those using centralized crypto exchanges will be able to reset their password. If you forgot your password, but remember your seed phrase, there is no need to worry.

While being able to reset your password due to using a centralized exchange is an upside, the downside is that the exchange owns your assets – not you. Unfortunately, many people learned this the hard way with the fall of FTX and therefore know the risks and therefore use a hardware wallet.

What Happens When Coins Are Lost?

The impact of lost coins can be detrimental for the person who lost the funds as it may be irreversible. On a broader, macro scale, many cryptocurrencies are hard capped (e.g. Bitcoin which will only ever have 21 million coins in existence) so lost coins result in a permanent decrease in the overall supply.

Chainanalysis – a blockchain data platform – has noted that roughly 20% of all Bitcoin is considered to be lost. The firm noted that their definition of lost was any Bitcoins that have remained at the same address for five years or longer. Are those funds truly lost, or do the owners just have diamond hands…who knows.

What is known is that there will only ever be 21 million Bitcoin, and this number can’t be changed. Satoshi Nakamoto – the mysterious creator behind Bitcoin – hard capped the cryptocurrency at 21 million to recreate the effects of having a finite supply.

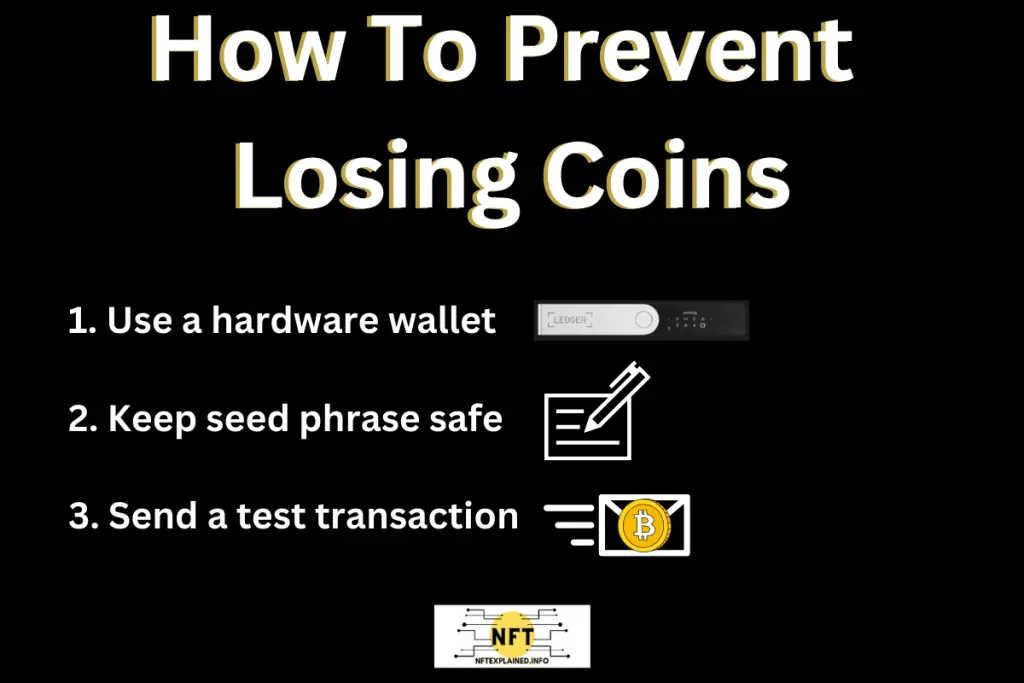

Best Practices To Ensure You Don’t Lose Coins

When it comes to decentralization, it is important to use best practices to ensure you don’t lose any coins. This includes using a secure wallet (i.e. a hardware wallet), keeping your seed phrase safe, and completing test transactions before sending large amounts of funds.

All of these best practices are quite simple to do and are essential for proper risk mitigation. If you would like to learn more about the importance of using a hardware wallet – and therefore being the actual owner of your assets – click here.

Additionally, keeping your seed phrase written down and stored in a safe location is essential. More on the importance of seed phrases can be found here.

The last safeguard or measure you can take to ensure that your crypto won’t be lost is to complete test transactions. Before sending big transactions, ensure that you have the correct public wallet address. Then, send a small amount to ensure that the receiving end gets the funds before sending the remaining, intended amount.

Historical Examples Of Lost Coins

James Howell, an early adopter of Bitcoin, mined approximately 7,500 BTC back in 2009 but discarded his hard drive which stored the access to the funds. The Newport, Wales resident has been unable to locate the hard drive due to the city council denying his search request due to environmental factors.

The former IT worker has even received approximately US $6.6 million to finance a plan to sort through 40,000 tons of waste; this plan involves using AI, two robotic “spot” dogs – which would sweep the area, and waste management experts among others (in his team of 8).

All things considered the council hasn’t budged even when offered a percentage of the approximately $350 million worth of funds.

Let our team know if you have ever lost coins or what you think about James Howell’s situation by connecting with us on Instagram, Twitter & TikTok! As well as subscribe to our YouTube!

Additionally, please consider supporting our team’s content creation through doing business with our partners: Trade stocks & crypto on Webull – get 2 free stocks. Buy a Ledger hardware wallet. U.S. users can get a crypto trading discount on Binance!