Slippage is something you have likely experienced from trading a range of financial assets like stocks or cryptocurrencies; slippage frequently occurs, especially when trading on the sport market – or when purchasing assets at the current market price. So What Is Slippage?

Slippage is the difference in price you intended to pay and the price you actually paid for a financial instrument like stocks or cryptocurrencies. Slippage occurs when purchasing/selling in the spot market – aka when trading at market prices – due to market volatility, liquidity, and more.

An example of slippage occurring in the cryptocurrency market is if you decided to purchase a full Ethereum coin for US $2,000 and click buy but end up paying US $2,050.

Trading in the spot market, or when sending out buying/selling orders at the market price, can result in more slippage than when using limit orders. Limit orders set a minimum price you are willing to sell the asset for and the maximum price you’re willing to pay for the asset.

Even when trading with limit orders, you may experience slippage as slippage occurs when prices move quickly. That being said, using limit orders can be a useful tool to mitigate against slippage.

Reasons for slippage include market volatility – a large change in price – which make it challenging for brokers to execute trades at the desired price. A lack of liquidity – or the lack of willing buyers and sellers; this may cause trades to execute at prices different than what was desired. Other factors include: order size, latency (or delays due to technical issues) and more.

What Is The Difference Between Positive/Negative Slippage In Crypto?

Slippage occurs in one of two ways; the first, is a way that is beneficial to the trader and the second, is a way that negatively impacts the trader.

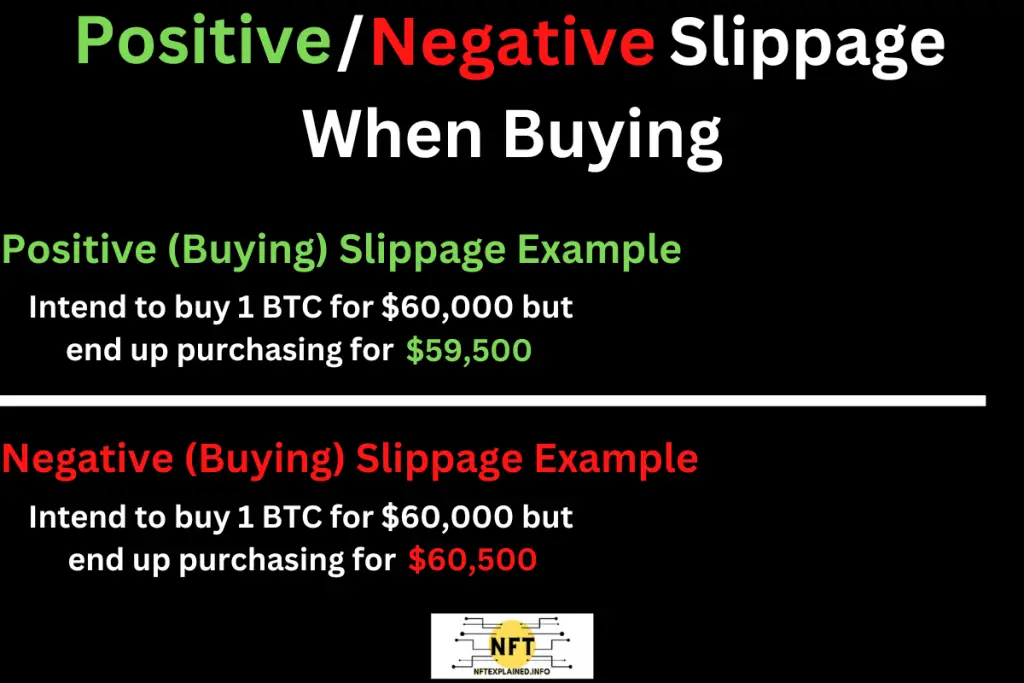

Positive slippage occurs when you buy an asset at a lower price than intended; this means you pay less than the intended price. Negative slippage occurs when you buy an asset at a higher price than intended; this means you pay more than intended.

An example of positive slippage occurring is when you intend to purchase 1 BTC for US $60,000 but the price falls and you end up purchasing 1 BTC for US $59,500. This means you received the asset at a price lower than what you were prepared to pay; this is a win.

An example of negative slippage occurring is when you intended to purchase 1 BTC for US $60,000 but the price rises and you end up purchasing 1 BTC for US $60,500. This means you received the asset at a price higher than what you were prepared to pay; this is loss.

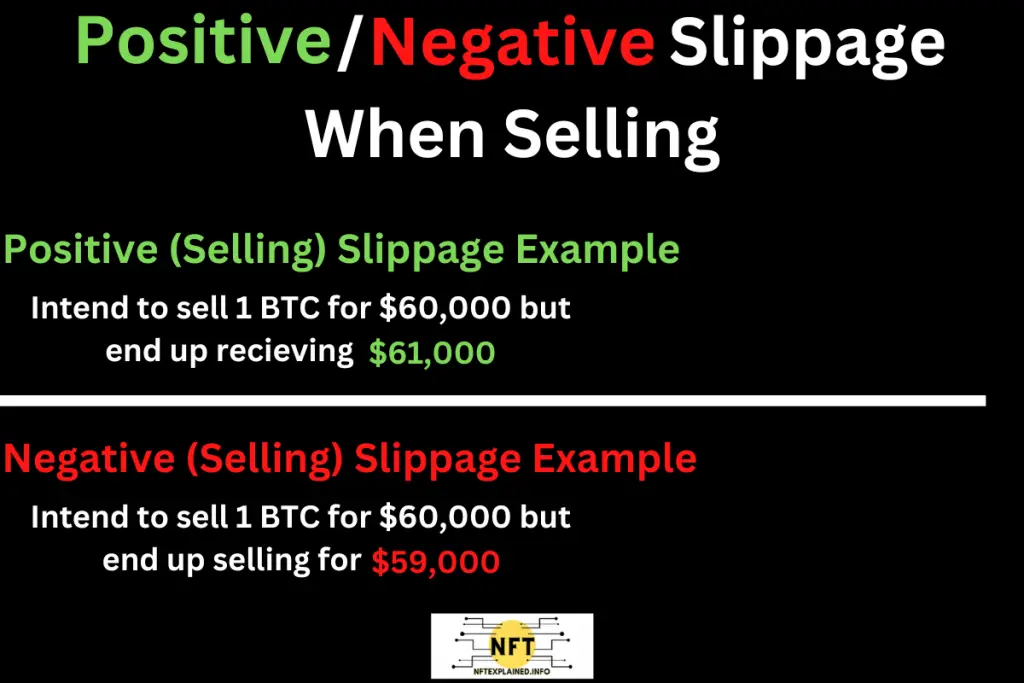

Positive and negative slippage can also occur when selling an asset. Positive slippage, when selling an asset means the trade executes at a higher/better price than intended. Let’s say you wanted to sell 1 BTC for US $60,000 but end up receiving US $61,000. This means you gained more for your 1 BTC than expected.

Negative slippage when selling an asset works the other way around, for example when you intended to sell 1 BTC for US $60,000 but ended up selling at US $59,000. This means you (the seller) received less for your 1 BTC than expected.

$1,000 slippage is quite a bit – however not totally uncommon – and is a hypothetical example that our team used to portray the effects of slippage. One way you can mitigate the effects of slippage is through setting a slippage tolerance.

What Is Slippage Tolerance In Crypto?

Slippage tolerance is a feature that most brokerages or exchanges offer; it allows you to set a percentage on the maximum acceptable difference between the intended trade price and actual trade price. If the assets price falls above or below the traders slippage tolerance, the trade won’t execute.

Within the cryptocurrency market, because it tends to be quite volatile, traders may sometimes have to accept the differences as it may not be possible to execute a trade if the slippage tolerance is set quite low.

Decentralized exchanges like Uniswap have slippage tolerances set in place – which is 0.5% – however this percentage can be adjusted. Centralized exchanges like Coinbase Pro feature slippage warnings before trades execute at more than 2% outside the last market price.

If you are safely securing your assets and in control of them by using a hardware wallet like a Ledger you will have the option to customize your slippage tolerance through the 1inch user interface. More on using the Ledger supported DEX in Ledger’s article linked here.

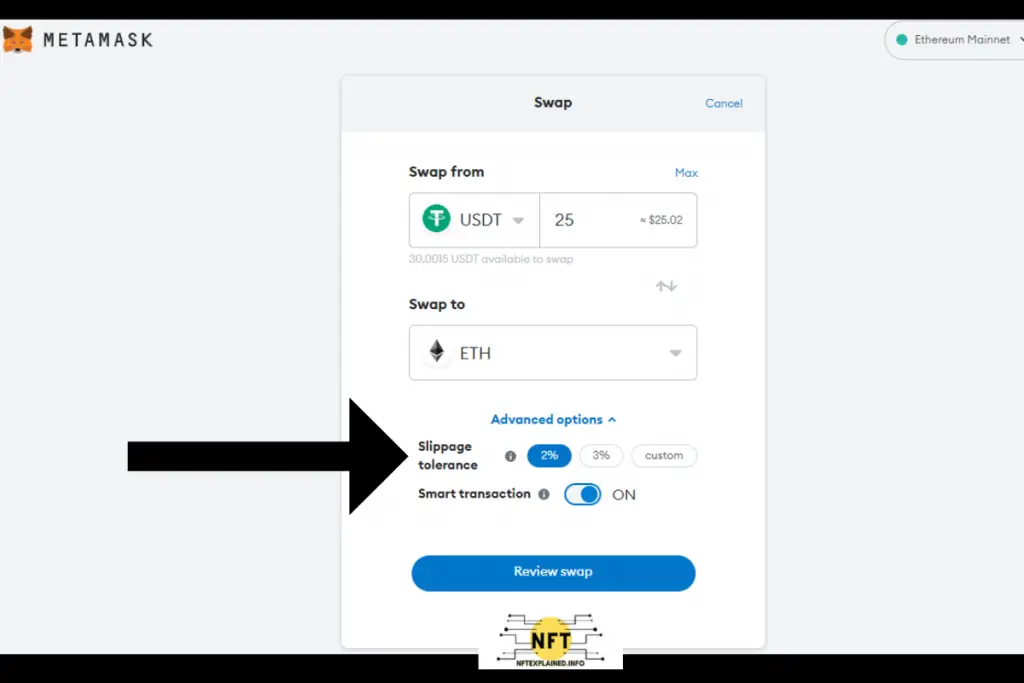

Additionally other blockchain based wallets like MetaMask have built in features that allow you to set slippage. To show an example of this our team decided to swap USDT for ETH. Once the amount is entered in you will have the ability to click on “Advanced options” in blue and enter your slippage tolerance.

If you found our content helpful please consider subscribing to our YouTube and following our team on Instagram, Twitter & TikTok!

Additionally, please consider supporting our team’s content creation through doing business with our partners: Trade stocks & crypto on Webull – get 2 free stocks. Buy a Ledger hardware wallet. U.S. users can get a crypto trading discount on Binance!