Before we dive in we want to preface this article with a quick but critical note: NFTexplained provide educational content and in no way are we providing financial advice. With that out of the way, let’s examine what crypto loans are and how they work.

Crypto loans are a form of secured loans in which cryptocurrencies are used as collateral in exchange for liquidity; liquidity can come in the form of cash but is more commonly cryptocurrency. This type of loan is typically received with few requirements and approval is often fast.

A secured loan is any type of loan where the borrower pledges something as collateral – like a house or car; with crypto loans, cryptocurrency is the collateral. Once you pledge cryptocurrency to receive the loan, you will have to make regular payments (like a typical car loan) including any interest charged.

One of the main benefits that comes with cryptocurrency loans – unlike typical bank loans – is that loans can be received without the traditional due diligence that a bank would require (i.e. looking at credit history and credit worthiness).

Some services will allow you to simply take out a crypto loan based on the amount of collateral you are able to put down. This brings us to the loan-to-value (LTV) ratio which is an important metric to understand. Let’s examine this in the next section.

How Much Can I Borrow Via A Crypto Loan?

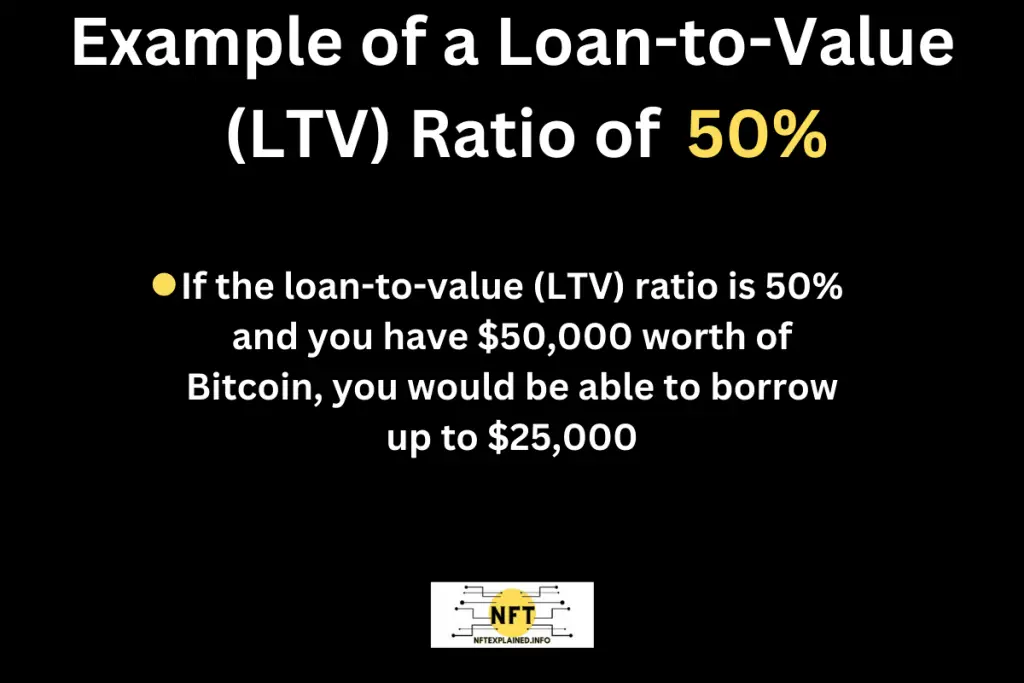

The amount you are able to borrow depends on the service you are using; however it will be largely dictated by the loan-to-value (LTV) ratio. LTV is a metric that can be found by taking the loan amount divided by the value of collateral pledged; LTV will be a %. Most lenders allow you to borrow up to 50% of your pledged crypto value.

For example if you had a 50% LTV ratio, you would be able to borrow half of the amount of cryptocurrency you are willing to pledge.

In this example, if you had $50,000 worth of Bitcoin and pledged it all, you would be able to receive $25,000 in fiat currency or other cryptocurrencies.

This brings us to our next question, why would someone take a crypto loan if they hypothetically had to pledge more than what they are able to receive?

Why Would Someone Take Out A Crypto Loan?

The primary reason you would take out a crypto loan, even if you pledged all your cryptocurrency, is to get access to cash or other cryptocurrencies without having to liquidate your holdings. You may do this for reasons such as thinking that the value of your pledged collateral (cryptocurrency) will increase.

This allows you to potentially receive future gains that come with price appreciation of your collateral – your cryptocurrency. Another reason you may take out a crypto loan is because of the speed at which you are able to receive it.

Receiving crypto loans is often a fast process as it is not uncommon for limited background checks or due diligence to be done, especially if the value of the loan is relatively small.

The final reason you may want to take out crypto loans is because of the favorable interest rates relative to other loans (e.g. credit card rates or traditional loans). Now that you know the benefits that come with crypto loans, let’s examine some of the risks.

What Are The Risks Of Crypto Loans?

Risks associated with crypto loans include receiving a margin call because the value of the collateral you pledged (i.e. the cryptocurrency) has fallen in price; this means you will have to provide more collateral. Platform risks – with regards to where and how your collateral is stored – should also be considered.

In order to maintain the loan-to-value ratio, you may have to deliver additional collateral because the value of your pledged collateral has dropped in price. Cryptocurrencies are volatile assets so maintaining the LTV is something that should be considered. In particular, this scenario should be considered when you have received fiat currency in exchange for the crypto you pledged.

Another issue you may face is the desire to liquidate your position of cryptocurrency that is being used as collateral; however, you will be unable to do so – because the loan has not been paid off.

A more unique downside to crypto loans is that the lender may go bankrupt; this is something we have seen with centralized exchanges like FTX. The FTX downfall taught us the importance of hardware wallets; a full explanation of the importance of hardware wallets can be found in this article.

Aside from bankruptcy, it is possible for a lending service to get hacked; so, taking into consideration how a lender stores your collateral is important as well as the company’s reputation. As with anything in this space, it’s important to complete your due diligence and carefully examine aspects like the terms and conditions of the loan.

Now that you know the pros and cons, let’s examine the other side of the coin, including how crypto loans can be profitable for you.

Lending Cryptocurrencies

Lending cryptocurrencies can be a profitable endeavor as it is possible to receive interest on the amount of money you have lent out; the amount you receive is often proportional to the risk of the borrower and the length of the loan (with longer loans having delivering interest rates for compensation).

Before choosing a service to lend your cryptocurrency, it is again important to do your due diligence and find a reputable site. Peer-to-peer lending platforms, which are decentralized, often facilitate the lending through smart contracts.

We have found that borrowing from a decentralized platform has higher fees than a centralized platform however there are downsides and upsides of both to be considered.

For example, decentralized platform generally allow you to maintain control of your assets; however, the smart contract can automatically take funds if you default on a payment. Centralized platforms like Binance maintain control over your assets but offer lower interest rates.

Most commonly, you will be able to receive compensation for lending through peer-to-peer lending platforms which work through smart contracts.

What Types Of Cryptocurrencies Can Be Lent Out?

The type of cryptocurrency that can be lent out depends on the lending service you are working with. Most commonly, cryptocurrencies with greater market cap such as Bitcoin, Ethereum, and a variety of stablecoins will be supported.

Cryptocurrencies with high liquidity are often supported; however, there are lending services that allow you to lend an array of cryptocurrencies including those with smaller market caps and those that are less well known.

Let our team know your thoughts on crypto loans and connect with us on YouTube and follow our team on Instagram, Twitter & TikTok!

Additionally, please consider supporting our team’s content creation through doing business with our partners: Buy a Ledger hardware wallet. Trade stocks & crypto on Webull – get 2 free stocks. U.S. users can get a crypto trading discount on Binance!