Before our team explains pairs trading within the crypto market, it’s important to understand where pairs trading originates and what it refers to in the context of the equities (stock) market. So, what is pairs trading in the stock market?

In the stock market, pairs trading is an investment strategy where the trader takes advantage of a mispriced asset by taking a long position and a short position in two financial instruments (e.g. stocks or funds) that are highly correlated (typically 0.80 or higher).

The idea is that profits from the long position offset losses in the short (or vice versa); this then results in overall profit. If stock A and B, let’s say Johnson & Johnson and Procter & Gamble, typically have a correlation of 0.85 but the two deviate from their historical trend, with a correlation of 0.50 – this could potentially be a good time to pair trade.

At this time the trader would take a long position on stock A (JNJ) – which would be the underperforming stock. The trader would also take a short position on the outperforming stock B (PG). The stocks would then hypothetically return to their typical correlation of 0.85 and the trader would profit from the long position in JNJ and the closed short position on PG. Profits from the long position in Stock A will offset the losses from the short position in Stock B – resulting in a profit overall.

In pairs trading, the trader typically closes the short and the long when both stocks have returned to their normal correlation; however, this decision will ultimately be the traders approach. Risk tolerance and market conditions may cause one position to be closed before the other.

Before moving on to pairs trading in the cryptocurrency market, let’s examine when this strategy began.

Pairs trading was a strategy that was possibly invented by a group of economists that were attending the University of Pennsylvania. This version of history is contested; some suggest that this strategy originated with a set of Morgan Stanley employees.

Something that often isn’t debated is that this strategy began in the mid 1980’s. Today, we see many market participants using this strategy including investment banks and hedge funds. Now let’s examine what crypto pairs are and what pair trading is in the crypto market.

What Is A Cryptocurrency Pair?

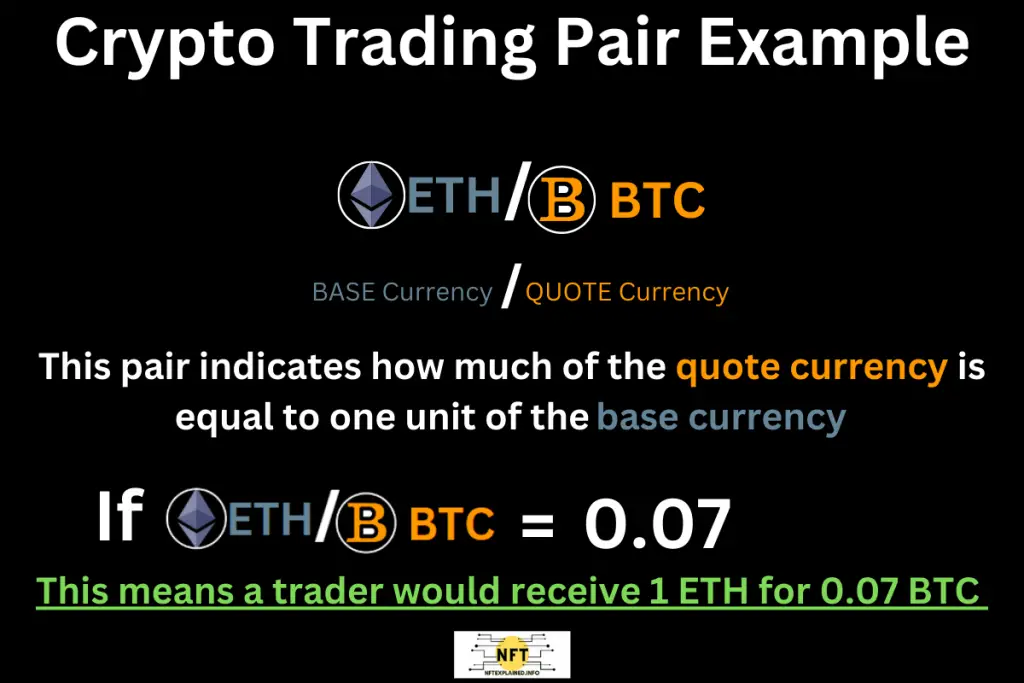

Comprehending cryptocurrency pairs seems like a complex topic however when broken down there are two parts that you need to understand. The first is the base currency and the second is the quote currency; allow us to delve into this further, including presenting a diagram for you to follow.

A crypto trading pair is a combination of 2 cryptocurrencies that can be traded as a single unit. The price of the trading pair is expressed as the amount of the quoted currency (1st crypto) required to purchase one unit of the base currency (2nd crypto).

A pair at 0.07 means you receive 1 full coin (1st crypto) in exchange for 0.07 of the second crypto (e.g. ETH/BTC = 0.07; this means a trader will receive 1 ETH for 0.07 BTC or 0.07 BTC for 1 ETH).

Now that you understand how crypto trading pairs work, let’s examine why crypto trading pairs exist and how you can trade crypto pairs.

Why Do Crypto Trading Pairs Exist?

Crypto trading pairs allow traders to trade one crypto for another without first converting to fiat. It also allows traders to compare costs between two cryptocurrencies in an easy manner. Additionally, crypto trading pairs allow traders to trade any pair given they hold the base (or first) currency.

Crypto trading pairs allow for decreased fees. Let’s pretend you wanted to exchange ETH for BTC however this trading pair (i.e. ETH/BTC) didn’t exist on a particular centralized or decentralized cryptocurrency exchange. This means the trader would have to find a trading pair ETH/USDT, then the trader would have to sell ETH to get USDT. Finally the trader can use BTC/USDT to buy BTC (what a hassle with numerous fees; finding a ETH/BTC pair would have been much easier).

Going back to our previous example about the ETH/BTC trading pair being = to 0.07, this allows traders to quickly identify that 0.07 BTC is equivalent to 1 ETH (or vice versa). The more traders are familiar with different pairs, the easier it is for them to quickly compare the two.

The final benefit of crypto trading pairs is that you can trade any pair as long as you own the base currency of the trading pair. The base currency is the currency before the “/”. So in the ETH/BTC example, you would be exchanging (the base currency) ETH for BTC. This means you can trade any pair that starts with ETH (i.e. any pair that is ETH/any other cryptocurrency).

Now, let’s examine how this trading strategy works with cryptocurrencies.

How Does Crypto Pairs Trading Work?

Most commonly, crypto trading pairs are with stablecoins like ETH/USDT; this is because these types of pairs make it easy for traders to calculate the value in fiat currency.

Crypto pairs trading works examining two highly correlated digital assets, and taking a long position in a cryptocurrency that is underperforming and taking a short position in a cryptocurrency that is over performing. Traders profit when the spread between the two diverge or converge.

Divergent traders will want the spread between the two to increase while convergent traders will want the spread to decrease. Most commonly (and with a converging pair trading strategy), the trader will profit from one cryptocurrency returning back to its regular correlation while the other cryptocurrency is simply used to hedge against the risks of something going haywire. Typically, the profits from one position outweigh the other, making this strategy profitable.

With a divergent pair trading strategy, the trader will have to successfully predict which one of the two stocks will outperform the other – rather than successfully predicting that the two will become closer in price.

Pairs trading requires more advanced technical knowledge as well as a strong understanding of the market. Factors like trading volume on an exchange need to be taken into consideration as illiquidity can rapidly decrease correlation between two crypto assets.

If you found our content helpful please consider subscribing to our YouTube and following our team on Instagram, Twitter & TikTok!

Additionally, please consider supporting our team’s content creation through doing business with our partners: Buy a Ledger hardware wallet. Trade stocks & crypto on Webull – get 2 free stocks. U.S. users can get a crypto trading discount on Binance!