NFTs or non-fungible tokens are unique one-of-one digital assets that have verifiable ownership via the blockchain. If you are looking for a more in-depth article as to what an NFT is, that can be found here.

NFTexplained.info is a team of long term crypto investors who are well versed within crypto and more specifically the NFT space. In this article, we will explain fractional NFTs and provide our take on the importance of fractionalization.

As a general statement, NFTs can be fractional – meaning multiple people can own ERC-20 tokens with each token representing fractional ownership of a single NFT. Numerous NFT marketplaces support this function. Tokens act as shares of an NFT which can be bought and sold.

A person who owns a lot of ERC-20 tokens for a particular NFT means that he or she has a high percentage of ownership in that particular NFT.

E.g. a person that owns 600 of 1,000 ERC-20 tokens known as ‘punk’ where ‘punk’ represents the ERC-20 token for a particular CryptoPunk. This person has 60% ownership of that CryptoPunk.

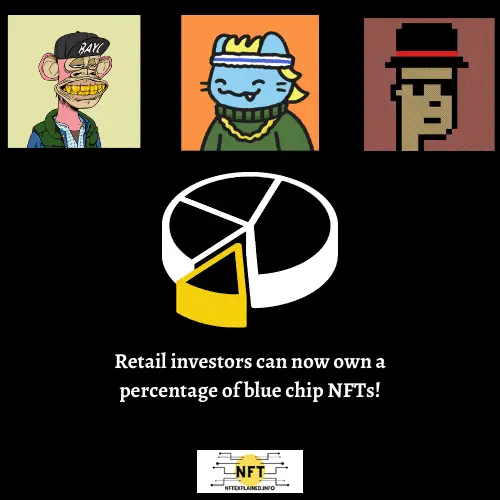

Fractional ownership has helped bridge the gap between the average retail investor and crypto ‘whales’ (a person/wallet address that holds a large amount of cryptocurrency and can afford expensive NFTs).

Crypto ‘whales’ are investors who can purchase top tier or blue chip NFTs such as Larva Labs’ CryptoPunks and Yuga Labs’ Bored Ape Yacht Club. Previously, the vast majority of retail investors would be unable to have ownership in these projects until fractionalized NFTs became possible.

Before fractional NFT marketplaces came about, the only way to purchase a percentage of an NFT would be by numerous purchases independently coming together to purchase an NFT under one account.

This method is extremely challenging as sending ETH across numerous wallets takes time and requires close communication. Also, having friends/people into NFTs and willing to do this is often difficult to come across.

Afterall, the NFT could have been purchased or the auction could have ended by the time these logistical steps were completed.

Fractionalized NFTs solve this problem in a convenient manner while making blue chip NFTs more accessible to the retail investor. Fractional NFTs are likely just getting started.

In this article NFTexplained.info will also cover where fractionalized NFTs can be purchased, the benefits that fractionalization brings, and we will conclude our article with an examination of some of the downsides.

Where Can I Purchase A Fraction Of An NFT?

As a general statement, a fraction of an NFT can be purchased from marketplaces like fractional.art. This marketplace allows for ownership through ERC-20 tokens. Once the tokens are in your digital wallet, you have governance and can help set the reserve price (votes are proportional to token ownership).

While other fractionalized NFT marketplaces exist, fractional.art is likely the most notable.

If you are interested in learning how to use fractional, such as how to purchase fractions of NFTs like CryptoPunks, find our tutorial here!

Screenshot taken from fractional.art of a Cool Cat where ‘Fish’ is the ERC-20 token that represents ownership.

After a successful purchase, Ethereum will be exchanged for the ERC-20 token. The ERC-20 token represents fractional ownership of the NFT. These tokens will appear in your MetaMask wallet.

Once acquired, ERC-20 holders have the option to vote on the reserve price. The reserve price is the price required to initiate an auction for a vault and its NFTs.

On the opposite side, sellers have the option to choose which NFTs they would like to fractionalize and the total supply of ERC-20 tokens.

The entire fractionalization process is decentralized and made possible through smart contracts. The fractional supply of ERC-20 tokens are stored in an audited smart contract vault.

If you would like to learn more about smart contracts, NFTexplained.info has created the perfect article for you. Click here!

What Are The Benefits Of Fractionalized NFTs?

As NFTexplained.info previously mentioned, numerous advantages arise from the fractionalization of NFTs.

As a general statement, fractionalized NFTs are useful in aiding the health of the overall NFT market. Fractionalization allows retail investors to possess a percentage of NFTs previously unobtainable. Fractionalization also helps in making more expensive NFTs have higher liquidity and more accessibility.

Some digital assets are priced at a point where the vast majority of investors are unable to purchase the NFT.

While some NFTs may have a lot of hype and purchaser intent, users simply can’t afford to buy the NFT and fractionalization helps solve this problem by making the NFT accessible.

By allowing a larger number of people to invest in an NFT that was previously unattainable, the NFT has higher liquidity and is more attainable to the typical retail investors.

It is highly likely that more and more NFT projects, especially those with high minting prices, will begin fractionalizing a portion of the NFTs they drop.

While fractionalization does solve numerous problems within accessibility and liquidity, there are still a few issues that arise.

NFTexplained.info will cover some of the downsides to fractional NFTs. These issues are likely to be fixed in the near future.

What Are The Downsides To Fractionalizing NFTs?

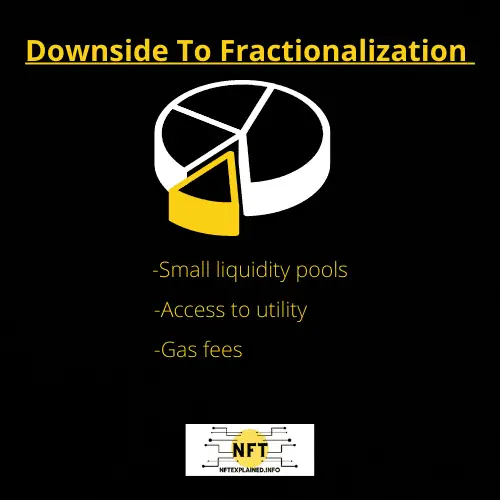

Although the fractionalization of NFT solves issues related to liquidity, there are still a few downsides of fractionalization at this point in time. These downsides include: receiving utility, gas fees, and the fractionalization of less expensive NFTs.

In terms of fractionalization, liquidity is both a positive and a negative. As NFTexplained.info previously mentioned, expensive NFTs become more affordable if percentage ownership comes into play.

However, the percentage ownership (or amount of ERC-20 owned) can also become an issue of liquidity if the liquidity pool for the fractionalized NFT is not large enough.

This can create problems with converting the ERC-20 token back into ETH or essentially cashing out.

That being said, this problem goes both ways as an expensive NFT may not be purchased because of the smaller number of purchasers who can afford the NFT.

Utility also becomes an issue when it comes to fractionalized NFT as airdrops won’t be able to be accessed as well as certain discord (or exclusive ownership chats).

When an NFT is being airdropped, the owner of the fractionalized NFT won’t receive that drop because they don’t hold the actual NFT (which is typically an ERC-721 token) in their wallet.

Instead they hold ERC-20 tokens which represent fractional ownership of the NFT, not the actual NFT itself. This has resulted in fractionalized NFTs missing out on airdrops.

As NFTexplained.info previously discussed, certain community related aspects like Discord chats can only be accessed if the NFT is stored in MetaMask. With fractionalization, the NFT won’t be stored; only a percentage of ERC-20 tokens will be stored.

Fractionalization also involves gas fees as transactions on the Ethereum network are not possible without gas. This makes fractionalization only viable for more expensive NFT – specifically NFTs worth more than eight ETH.

While these problems are not overwhelming, they are still something to consider. The NFT space moves extremely fast and it is likely these problems with fractionalization will soon be resolved.

We hope you are just as excited as we are about NFTs and continue to stay informed at NFTexplained.info. To get the latest news in this rapidly evolving space, follow our team on Instagram & Twitter!