Non-fungible tokens (NFTs) have gained immense popularity since their rise to prominence in early 2021, coinciding with the explosive growth of the NFT market. Although NFTs have sparked controversy, I personally believe that the underlying technology has the potential to revolutionize numerous markets. This belief has been strengthened by the involvement of prominent corporations such as Nike and the California Department of Motor Vehicles, both of which have started issuing NFTs.

While I understand that you may not share the same viewpoint, I encourage you to read the entire article to gain a comprehensive understanding of what an NFT truly represents.

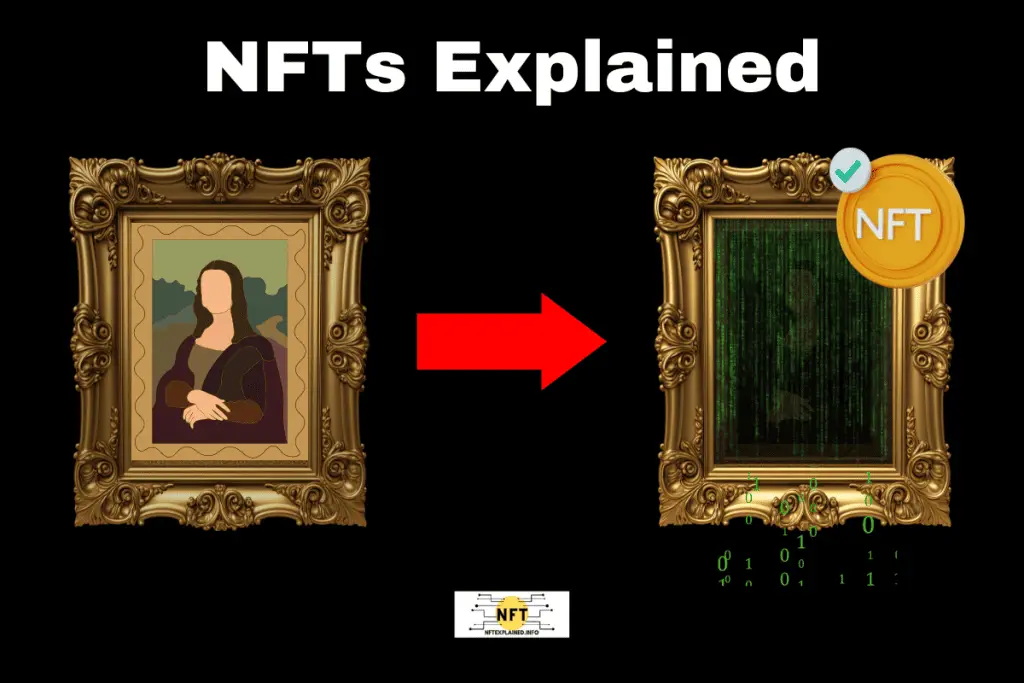

NFTs, short for “non-fungible tokens,” represent unique, one of one, digital assets that utilize blockchain technology to verify a person owns a digital asset – such as a JPG, MP3, or GIF. Each NFT represents a unique item, serving as a mechanism to establish ownership and ensure authenticity within the digital realm.

Think of an NFT as a digital item: music files, art, or real estate that offers proof of ownership. By owning an NFT, you gain the ability to sell the item and enjoy any associated benefits or utility that comes with it.

Allow me to provide a further explanation of NFTs and some of the unique implications they bring to the table aside from proof of authenticity within the online world.

Demystifying NFTs: Understanding Their Significance & Use Cases

Let’s delve into the myriad of benefits that NFTs offer, extending far beyond the ownership of digital cat pictures. Following this section, I’ll explain more of the technical side of NFTs including the blockchain aspect of it.

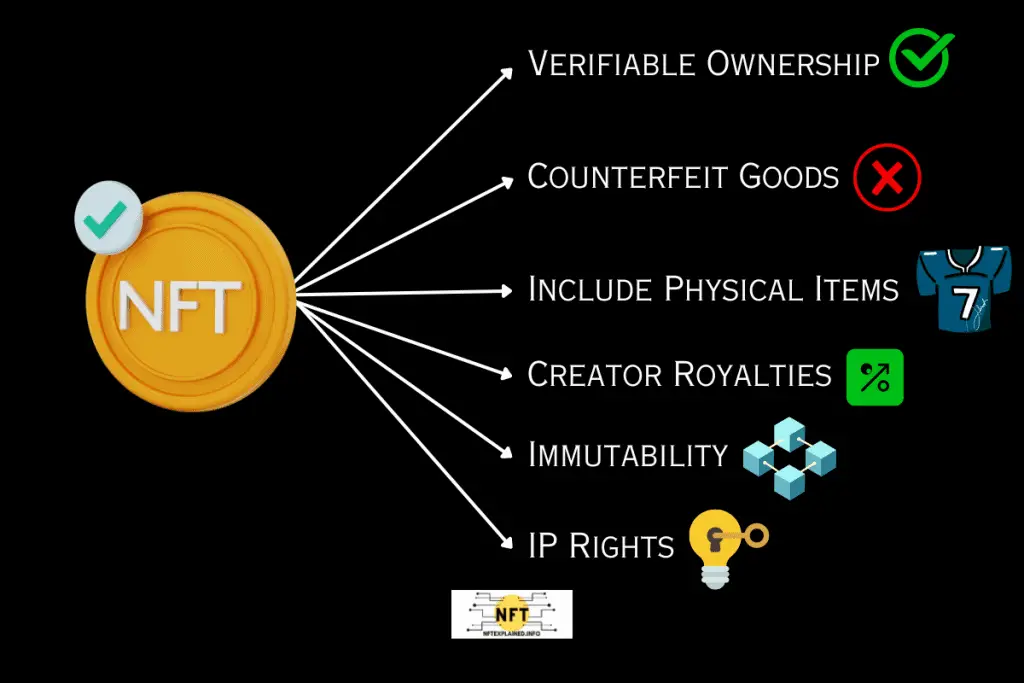

NFTs redefine digital ownership, offering benefits like owning in-game items and verifying authenticity. They combat counterfeiting and can include physical items. NFTs allow creators to embed royalties, receiving a percentage of secondary market sales. They find use in important documents, ensuring immutability and efficient transfer (e.g. car titles).

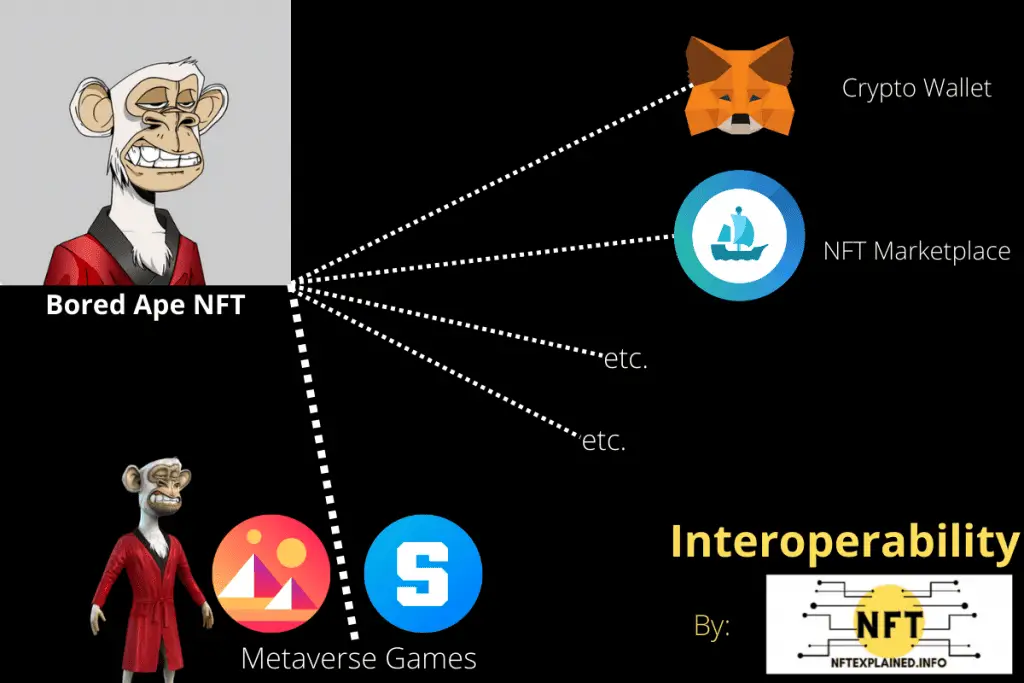

One of the most straightforward examples is owning a virtual item in a video game. With NFT ownership, you can effortlessly transfer it to another person with a digital wallet, trade it on third-party marketplaces in exchange for cryptocurrencies like Bitcoin or Ethereum, and even explore the possibility of using it in other games if interoperability is supported.

With regards to the counterfeit market, NFTs serve as a means to verify the creator and previous owners of an item, addressing concerns of forged goods. Seeing who previously owned an item is a critical element of provenance and is something unique to blockchain technology; I wrote an article explaining the implications of this and I highly recommend you check it out.

Furthermore, when purchasing an NFT, you have the potential to receive additional utility beyond digital ownership. This could include physical items like artwork or a signed jersey, offering tangible value that can be proudly displayed and enjoyed in your home. It’s important to note that merely screenshotting an NFT overlooks these valuable benefits, such as exclusive access to real-world events and other unique experiences.

NFTs also grant creators the ability to embed royalties, enabling them to receive a percentage, typically 5%, of each subsequent sale when the NFT is traded on the secondary market (e.g. OpenSea).

This newfound feature empowers creators with ongoing financial benefits and represents a unique opportunity that is exclusive to NFTs. It revolutionizes the way creators can monetize their digital assets and introduces control over the long-term value of their work.

Additionally, NFTs offer a compelling use case for important documents, such as car titles. As car titles become digitized as NFTs in California, citizens will benefit from enhanced security, as the immutability of NFTs prevents tampering once minted on the blockchain. Moreover, NFTs enable more efficient and digital transfers of assets (e.g. car titles), streamlining the process and reducing administrative burdens.

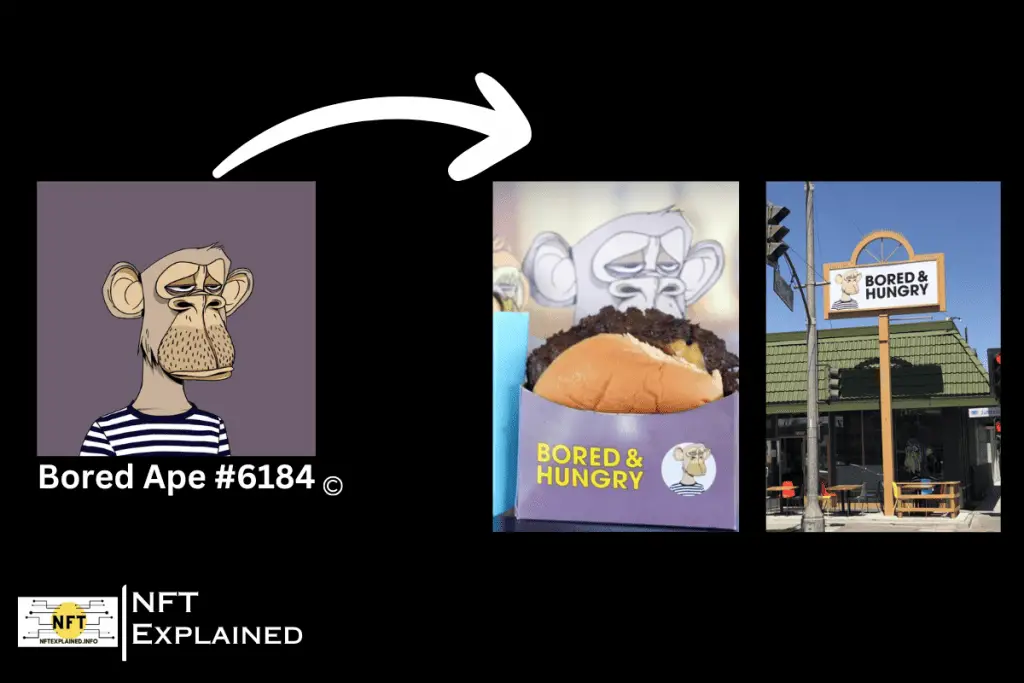

Lastly, NFTs grant intellectual property (IP) rights to the actual work, enabling the asset to be monetized. An interesting example of this is the opening of a restaurant called “Bored and Hungry,” which utilized the IP rights of an ape to create the restaurant’s logo. NFTs offer unique opportunities for creators to leverage their IP in innovative ways, extending beyond traditional means of monetization.

Decoding NFTs: Understanding Each Element Of Non-Fungible Tokens

‘NF’ signifies non-fungible, denoting an irreplaceable item that stands alone, unlike fungible assets of equal value. The ‘T’ represents token, encoding ownership like a digital stamp certifying possession of the asset. This certificate is stored on the blockchain – a distributed database.

The term “token” in Non-Fungible Token (NFT) refers to a specific type of asset known in the blockchain world as an ERC-721 token. NFTs, being blockchain-based, are primarily acquired using cryptocurrencies like Bitcoin and Ethereum.

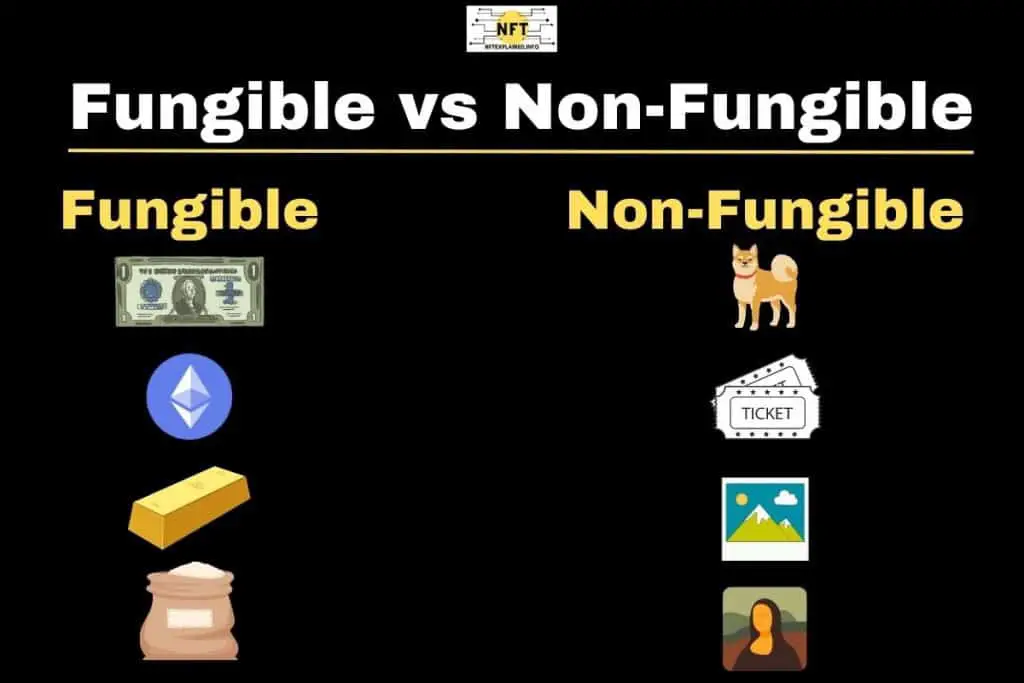

You may be wondering how each NFT is considered non-fungible even if they are visually the same. Speaking of non-fungible, I’ll provide illustrative examples of both fungible and non-fungible items in the next section to help you understand the difference. Getting back on track, visually identical NFTs are different due to the unique token ID of the asset.

NFTs can represent identical digital pieces, but each one possesses uniqueness due to individual numbering and other subtle factors, such as the specific upload time to the blockchain.

Consider an NFT as a limited edition sports card featuring your favorite athlete. While visually identical, each purchased item remains non-fungible, possessing unique ownership and verification on the blockchain. These NFTs could even potentially appreciate in value due to limited supply and increasing demand; more on basic NFT economics can be found here.

Exploring Fungible vs. Non-Fungible: Real-World Examples and Significance

Non-fungible items possess unique value, making them irreplaceable, while fungible items are interchangeable. NFTs are non-fungible, each being one of a kind, unlike fungible cryptocurrencies like Bitcoin, where each unit holds equal value.

Fungible Examples:

$1 USD (You and I could exchange one dollar bills and neither of us would care as they hold the same value)

1 ETH (one coin of Ethereum is of equal value to another coin of Ethereum and therefore, they can be interchanged)

1 ounce of gold (equal to another ounce because they are the same)

1 bag of unopened grade A white rice (equal to another bag of grade A, given that the bag has not been opened)

Non-fungible Examples:

Dogs (If I had a dog and you had a dog and we exchanged them, they would not be of equal value for numerous reasons like memories made together. Neither of us would be happy.)

Movie tickets (Not exchanged for equal value because of the perceived value of seating locations and because it’s held at a specific time.)

Photograph from a specific event (The photograph from every angle is unique as well as the time it was taken.)

Mona Lisa Painting (A unique, original piece of art that can’t be swapped for a replica.)

Understanding The Blockchain: The Backbone of NFTs

NFTs leverage blockchain’s strength by securely storing unique file data in decentralized blocks, ensuring safety and immutability. Blockchain enables provenance or the tracking and verification of the item history, and empowers creators to embed royalties from the NFTs’ secondary sales.

In order to fully understand how this works, I’ll provide a brief explanation of how the blockchain operates and why its decentralized nature adds to its uniqueness and security.

The blockchain acts as a public ledger, allowing everyone to view transaction details within each block, albeit in a pseudonymous manner (e.g., wallet: 0x47gtJ8… sold an NFT to wallet: 0xGLY6H87…). This transparency ensures accountability and integrity, serving as the foundation for NFT transactions and fostering trust in the digital ecosystem.

Miners (or computers running algorithms like Ethereum’s), facilitate the consensus among computers worldwide to validate NFT transactions and maintain the blockchain’s integrity. Miners receive rewards, often in the form of that blockchains native cryptocurrencies (e.g. ETH), for their computational efforts.

Each block’s hash links to the previous block, ensuring data immutability and making any changes easily detectable. This inherent reliability and the decentralized nature of blockchain make it virtually impossible for the system to fail unless all participating computers shut down in a peer-to-peer network.

Each NFT has a specific group of blocks that have information proving ownership of the digital asset and making it possible for people to essentially own a digital receipt.

To conclude the article, I’ll provide some examples of NFTs that have been released in the past.

Exploring Notable NFT Examples: A Glimpse into the World of Digital Collectibles

Taco Bell – The company auctioned off 25 NFTs, including one featuring tacos colliding in a mesmerizing pendulum wave motion. Each NFT owner was rewarded with a special perk—a $500 gift card that could be redeemed at Taco Bell. The proceeds from the auction were donated to the Taco Bell Foundation, supporting their charitable endeavors.

Virtual Real Estate – In virtual worlds like Decentraland and The Sandbox, virtual land is represented as NFTs. People have bought and sold virtual real estate within these metaverses, creating unique digital environments and experiences. Ownership of these plots allow the user to design and utilize the land as they please for all other users to experience.

NBA Star: LaMelo Ball – Rarity and scarcity make these NFTs desirable and allow for potential price appreciation. By owning his NFT, you can potentially receive game-worn memorabilia. Each NFT is tied specifically to an aspect of LaMelo’s career and updates in real time through the use of smart contract oracles. More on LaMelo’s project can be found here.

Bored Ape Yacht Club – Owners of Bored Ape Yacht Club NFTs receive exclusive benefits such as access to future NFT drops, including airdrops or free digital assets. Additionally, they gain entry to exclusive groups, real-world yacht parties, IP ownership of their ape, and the ability to utilize their NFT in metaverse-related games like The Sandbox.

Axie Infinity – Axie Infinity is a blockchain-based game where players can collect, breed, and battle digital creatures called Axies. The in-game Axies are NFTs, and some rare and desirable Axies have sold for significant amounts. Using the Axie NFT, players could battle and earn SLP, the game’s native cryptocurrency – which can be exchanged for other cryptocurrencies or fiat via a cryptocurrency exchange.

If you are interested in learning ways to get noticed and grow in this fast evolving space. I recommend checking out this article where nine different techniques were examined, which had been given to us by famous creators in this space!

I hope you found this article informative and continue to stay informed with NFT explained. You can find us on YouTube, Instagram, Twitter & TikTok.

If you found value in our content or wish to support our educational mission, you can collaborate with our partners by utilizing these affiliate links: Purchase a Ledger hardware wallet! U.S. users can get a crypto trading discount on Binance!