In this article NFTexplained.info, who are a team of long term crypto investors, will explain what a rug pull is. The team will explain how they occur with cryptocurrencies and NFTs; we will also break down different signs of a rug pull to help you identify them and not get scammed.

We would recommend reading the entire article as this valuable information will likely help you notice a frightening scam before even investing. At the end of our article, we will provide some resources to help you investigate.

Let’s dive in!

A “rug pull” is a term used within the crypto world to describe a scam in which developers/founders of a project don’t fulfill their promises after receiving funds. Essentially, the founders run away after receiving an investment. This scam can occur with crypto currencies as well as NFT projects.

Most commonly, rug pulls happen when a founding team is anonymous as this allows them to quietly and sometimes quickly disappear.

The founding team behind a project is one of the most important aspects to consider before investing in anything. In the NFTexplained.info article of the top ten tips to consider before investing in an NFT project, we extensively discuss the importance of the founding team.

Since the crypto space is rapidly evolving, many people are trying to get in on outsized profits, including those who are morally bankrupt.

In order to help you mitigate investment risk, NFTexplained.info will explain how these scams can occur and how to spot them.

In What Ways Can Developers/Founders Rug Pull (Scam)?

When it comes to rug pulling there are numerous ways in which this can occur.

In the crypto space, “rug pulls” can occur in NFT projects post mint, after the founders receive funds. With smaller cryptocurrencies, this scam can occur in three distinct ways – by developers selling all their shares, by simply removing the ability to sell, and by removing liquidity.

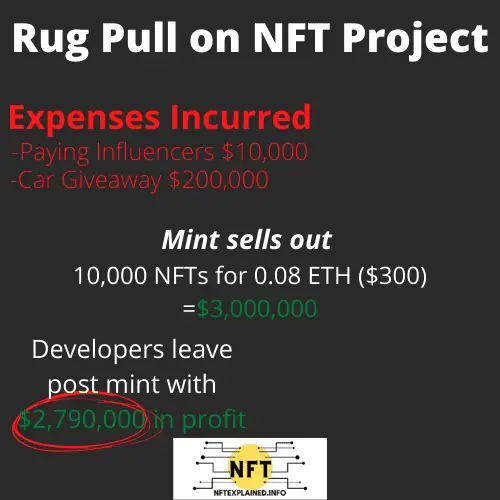

Founders of an NFT project may spend a lot of money in order to hype up a project even though they intend to do a rug pull.

The hype could be driven by paying influencers to talk about the project, giving away expensive items, and more. Although the founders incur some expenses in making the project look authentic, they can still receive enormous profit from this scam.

With smaller cryptocurrencies, unfortunately many people are quick to invest while doing very little research. This can lead to investing in rug pulls.

The first way this can occur is by the developers selling all the tokens they held for themselves once the price gets high. These tokens could be sold rapidly, in a manner of a few minutes, or slowly over a longer period of time.

The second way this scam may occur is by developers of a token removing the ability to sell the token. Purchasers will be unable to sell as the developers have added code removing this ability. Oftentimes, this code only allows developers to sell.

Developers could be selling tokens they reserved at minting for themselves or tokens that they had purchased when the price was very low.

The third way this scam can occur is by removing liquidity, which typically only occurs in a small market cap currency. In this variant of the scam, founders will invest a large amount of an expensive token like ETH to be exchanged for their scam token.

Since they are investing a large amount, the price will likely shoot up and this will entice others to invest.

Once the price is even higher they withdraw all the expensive tokens, leaving no liquidity for others to do anything. With no liquidity, people are unable to buy and sell so the project will simply die.

How To Tell If An NFT Project Is A Rug Pull – Avoid This Scam!

NFTexplained.info will cover signs that are likely to be an indication of a rug pull. Here are some red flags to be aware of.

As a general statement the most important factor to consider is the founding team; if they are anonymous, it is cause for significant concern. If the giveaways, website, and social media look fishy, it may be because they are trying to make a quick buck. Always be cautious and do your own research.

By simply doing a Google search and checking out the social media links for a given NFT project, risk is mitigated.

Checking LinkedIn and more than the first link that comes up after searching the developers name will likely tell you if the developer is anonymous and using a pseudonym.

Aside from that, researching the founding team is something that should always be done before investing in a project. While some anonymous teams do work out, it is much more risky.

Checking to make sure the founders follow through with promises, like giveaways, is key. Some projects that are rug pulls may not even fulfill their earliest promises of giving away certain things (even before the mint occurs).

Additionally, if the website looks like it was hastily put together or has errors, this is an enormous red flag. If a project is going to fulfill their promises, it is unlikely that they will have spelling errors and slow site speeds.

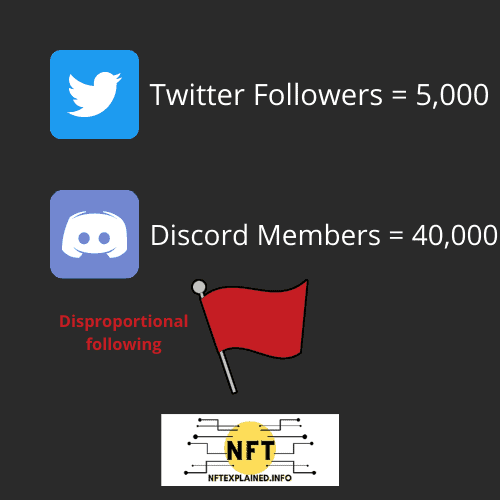

Social media can also be a good indicator in identifying a rug pull. If the social media has a low following on Twitter but an enormous following on Discord or Telegram, this is a red flag.

Checking engagement and as NFTexplained.info previously mentioned, disproportional followers will likely tell you that bots are being purchased to make it appear like there are a lot of people looking to engage with a project.

Now NFTexplained.info will cover some signs to watch out for when investing in cryptocurrencies.

Signs A Cryptocurrency Will Be A Rug Pull – Avoid This Scam!

As a general statement, the first thing to check is the developers behind the project. Additional things to check include: locked liquidity, the project’s whitepaper, high percentage ownership by few people, absurdly high staking rewards, fishy website, and looking further into the code.

NFTexplained.info will examine what these metrics are as well as how to check them.

NFTexplained.info can not stress how important the developers or team behind a project is. Checking links and establishing the credibility of the developers is very important.

Checking to see that a token locks a large amount of liquidity, for a long period of time, is a great sign. Developers won’t be able to rug pull if the vast majority of liquidity is locked.

Low liquidity – say US $100,000 or less – can very easily be manipulated and should be considered a huge red flag. This also suggests the developers have little money to put into the project.

The whitepaper, or the paper explaining the problems that a token is looking to solve should be looked at before making an investment.

If the whitepaper appears more like an advertisement and is less than roughly twenty pages, this is a prominent red flag.

The whitepaper should detail the currency’s use cases while including graphs and charts. An unprofessional white paper is a huge warning sign.

Checking out the percentage ownership in a token is always a good move as even if the project is not a rug pull, it is important to know that there are whales who may be able to influence the price.

It is especially important to check percentage ownership with small and new tokens.

NFTexplained.info recommends using blockchain explorers (e.g. etherscan.io), to check percentage ownership for a specific project.

By finding the tokens’ contract address and plugging it into a blockchain explorer, you will be able to see information like top holders by percent, market cap, and circulating supply.

A good sign to see is a multisig wallet meaning multiple developers have a key. For example, if there are five developers, then the multisig wallet could require three to agree in order for a transaction to occur.

It is important to note that the developers could lie about the number of people founding a project however, it is still important to look into along with the other topics examined by NFTexplained.info.

A project with high APR (annual rate of interest paid on an investment) may be a red flag; if the tokenomics appear to be too good to be true then it may actually be a scam. Very high percentages should arouse suspicion.

As with NFT projects, it’s always important to look at the website. If it looks unprofessional or has spelling errors, this is an almost definite sign of a scam.

NFTexplained.info mentioned looking further into the code. By this we mean checking the similarity of a token to another token. This can be done on sites like tokensniffer.com which shows how similar two tokens are.

If two tokens have a high similarity percentage like 80-100%, this is a good indicator that the project is a scam.

Also checking the crowdsourced site rugdoc.io is another useful tool as it solicits input from the crypto community to tell you how likely the token is to be a scam.

A safe way to avoid being scammed is by only investing in top 100 crypto currencies by market capitalization.

We hope you are just as excited as we are about NFTs and continue to stay informed at NFTexplained.info. To get the latest news in this rapidly evolving space, follow our team on Instagram & Twitter!