NFTexplained.info is a team of long term crypto investors who are well versed in the NFT space. We have the goal of providing valuable educational content. In this article we will discuss if NFTs are pyramid schemes and much more.

Let’s dive in.

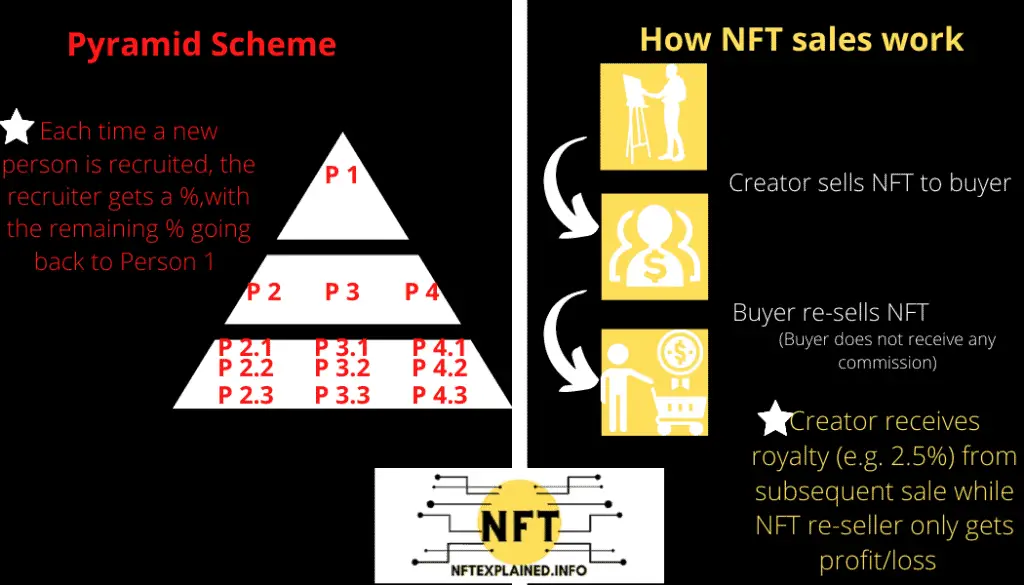

NFTs are not pyramid schemes; NFTs provide proof of ownership of digital assets. In a pyramid scheme, recruiters receive a percentage of the ‘new member joining fee’ with the remaining percentage flowing to the person on top. NFTs only return royalties to the creator of the NFT.

NFTs or non-fungible tokens are blockchain based assets that allow someone to prove they own an item. Essentially, NFTs are receipts that verify the owner of a digital item.

When an NFT is created, so is a smart contract. This contract governs royalty distribution. The smart contract creator can specify royalty distribution. A common practice is to dictate that a percentage of secondary sales are returned to the creator of the NFT. Although on the surface, the funds flow is similar, this is not a pyramid scheme.

In a pyramid scheme, secondary sellers are rewarded with a small commission while the remainder of the commission flows back up to the top of the pyramid. Those at the top of the pyramid receive the most money and those towards the bottom of the pyramid receive the least. The funds flow here is opaque to all participants except the person at the top of the pyramid.

With NFTs, the secondary seller does not receive commission. Instead, the creator – at their discretion – receives commission from the secondary sales; again, this depends on publicly legible terms the smart contract has ingrained.

NFTexplained.info will now provide some illustrative examples why NFTs are not pyramid schemes.

The first point that differentiates the two, is the fact that recruiting someone to purchase an NFT line (e.g. BAYC) that you currently own will not deliver you any commission or direct benefit.

Recruiting a new BAYC buyer will not be enough to influence the floor price – or even the price of an Ape with the same traits – given that the collection consists of 10,000 units.

The second aspect worthy of consideration is that NFTs with meaningful value have utility while pyramid schemes have no intrinsic value at all.

An illustrative example of utility in an NFT project is the ability to attend real world events. Holders of certain NFT projects may receive access to exclusive events where the NFT acts as a ticket to the event.

In comparison, the vast majority of pyramid schemes do not have any intrinsic value. Pyramid schemes rely heavily (in most cases exclusively) on new recruits and getting a percentage cut from getting others to participate in the scheme.

NFTexplained.info has also thoroughly covered additional topics related to manipulative or illegal activity in NFT marketplaces such as NFTs and Money Laundering as well as NFT relation to wash trades.

Are NFTs Multi Level Marketing Schemes?

NFTs are not multi level marketing schemes as sellers of an NFT do not receive a commission for selling a creator’s work. The holder of an NFT has no continued commercial incentive to recruit people to purchase an NFT project they own; it brings them no commission and likely no benefit.

In order to really comprehend the answer to this questions, we must first understand multi level marketing (MLM) schemes. The team at NFTexplained.info will break down MLM schemes.

Unlike a pyramid scheme, a MLM scheme is a legal business practice however it is considered controversial by many and some extreme examples are similar to a pyramid scheme.

MLM schemes work by selling a product to someone, with the seller receiving a commission on the sale. While the seller does not have to recruit additional people to sell the product, he or she is incentivized to do so in order to secure a commission on the sales their recruit makes.

MLM schemes are different then pyramid schemes because MLM schemes typically include selling a product as the main source of income whereas a pyramid scheme typically generates income exclusively from recruiting new participants.

In MLM schemes, sellers are often selling a product to those they have a personal connection with. With NFTs, those looking to purchase are often not connected to the seller in any way – they have no relation to them.

If a holder of an NFT project was to recruit more people to purchase the NFT they hold, they would not receive any commission and as NFTexplained.info previously mentioned, it would likely not be enough to influence prices of the entire project, resulting in no real benefit to them.

With MLM schemes, the incentive to recruit people is high and continuous but with NFTs there is little to no incentive to recruit people. If you are the holder of an NFT project like Cool Cats, it’s highly likely that you don’t care if someone continues to hold or sell as it likely doesn’t affect the floor price for the NFT project as a whole. If you are interested in learning about floor price, our team has linked that article here.

Only some creators – those who have smart contracts that enable a royalty from secondary sales – have an incentive to drive secondary market transactions. This incentive is higher if they are able to provide enough utility for the project. Utility will cause people to hold onto the project until a certain price is reached when they would rather sell for profit then hold for utility.

Are NFTs A Con?

NFTs are not a con; but, rather digital assets which can take numerous forms – JPG, MP3, or GIF – and can be verified to a single owner via the blockchain. They hold value because of the utility (e.g. physical items for holders of an NFT) they provide and the fact they can be bought and sold.

Aside from physical items, NFT utility can come from airdrops or receiving tokens or an additional NFT from holding the original. More examples of utility include access to real world events; in this case, the NFT acts as a ticket to attend.

Aside from the utility they provide, NFTs are being sold for high prices because of the supply and demand economics behind them. If you are interested in learning more about how the NFT market works, click here.

Are NFTs Legitimate?

NFTs are a legitimate form of blockchain technology. While there are NFT scams – as with anything that has an abnormally high rate of growth – the technology backing NFTs is by the book. The utility they provide by owning them makes them valuable.

In any industry that grows at an exceedingly high rate, there will likely always be people looking to make a quick buck in an unethical way (i.e. a rug pull).

At this point, the NFT space has little regulation which may contribute to the scams however the technology and smart contracts that make NFTs possible are completely legitimate.

Are NFTs A Good Investment?

NFTs can be a good investment if the investor has completed their due diligence and is very up to date in the fast moving NFT marketplace. While some projects fall to zero value, other projects provide exceptional gains so understanding trends and the aspects that can make a project successful is worthwhile.

NFTexplained.info is a team of crypto investors; we are not financial experts, and none of the information we provide is financial advice. Please do your own due diligence.

The NFT space moves very fast and there are numerous sub categories of NFTs that are quickly evolving. Specializing in one sub category may be beneficial but keeping up to date with the fast changing market is key to investing successfully.

There are numerous different factors that should be considered before investing in an NFT project. Maybe most importantly is the founding team. If you would like to read our team’s guide on identifying successful projects and some of the aspects to consider, that breakdown can be found here.

Can You Lose Money With NFTs?

Similar to other asset classes, money can be lost by purchasing NFTs. While some projects have exceptional returns, others quickly fall to zero. Completing your due diligence – like researching the founding team – is key before investing in a project.

Rug pulls (when the founding team does not fulfill their promises after receiving an investment) do occur in the NFT space. If you would like to learn more about rug pulls, and how to avoid them, NFTexplained.info will link that article here.

The team at NFTexplained.info would not consider NFTs to be reliable investments as some skyrocket while others go to close to nothing. The art aspects, social aspects, and the fact that NFTs often appreciate are some reasons why people venture into the space.

Why Are NFTs Controversial?

NFTs can be a controversial topic because of the energy they consume; however, energy consumption depends on the consensus algorithm used and some NFT’s consume little energy. Additionally, scams do occur in the fast-evolving NFT space so completing your own research is highly recommended.

If you are interested in learning more about the amount of energy an NFT consumes as well as why – the different consensus algorithm used by blockchains – click here.

The NFT space is always changing and the technology is quite new. Our team is incredibly excited to see what will happen as time goes on. To get the latest news in this rapidly evolving space, follow our team on Instagram & Twitter!